In the last week, Bitcoinhas seen an impressive 7% increase in its price, raising questions about the future trajectory of the cryptocurrency. As investors and market analysts anxiously assess the factors driving this growth, many are wondering where bitcoin is headed next and the potential hurdles it may face along the way.

Grayscale reports growing popularity of Ordinals

Ordinals, a new non-fungible token (NFT) rapidly gaining popularity on the bitcoin network, is attracting the attention of institutional investors. On 27 April, Grayscale Bitcoin Trust (GBTC)Leading institutional cryptocurrency fund, published an article discussing the benefits of ordinances for the bitcoin network.

The article suggests that ordinals could increase bitcoin miner fees and lead to a cultural shift within the bitcoin ecosystem.

Grayscale argues that ordinals emerged as a result of their use of the existing bitcoin network and subsequent crypto developments. The rise of ordinances could fuel a community and culture supportive of the bitcoin network and its ongoing development.

According to the report, Ordinals may attract new users who may not have previously considered adopting bitcoin. This increased interest could potentially benefit BTC/USD.

Binance Poised to Re-enter Japanese Market After Sakura Trading Bitcoin Acquisition

Binance is set to re-enter the Japanese market after acquiring licensed crypto trading platform Sakura Trading Bitcoin (SEBC). As of May 31, SEBC will cease providing its current cryptocurrency exchange and brokerage services. After June 2023, SEBC is expected to relaunch as Binance Japan.

The leading cryptocurrency exchange has faced regulatory compliance issues in several countries but has managed to mend its relations with regulators.

Furthermore, Japan was one of the first countries to establish regulations for cryptocurrencies. The nation recently relaxed regulatory requirements for cryptocurrency platforms, making it easier to launch new crypto coins.

As a result, the return of the world’s top cryptocurrency exchange to Japan is beneficial for the leading cryptocurrency, BTC/USD.

Congressional Hearings Aim to Establish Clear Cryptocurrency Regulation

Regulation is a significant concern in the cryptocurrency sector. The community wants a clear regulatory framework, but the regulators have not clarified the rules of conduct.

To address the issue, Patrick McHenry, chairman of the House Financial Services Committee, has planned to A series of joint hearings to examine the structure of the US digital asset market.

According to the joint of 27 April releaseSeveral prominent members of the US Congress have come together to create a more transparent regulatory framework for the US digital assets industry. The announcement states that the committees will collaboratively approve and sign into law clear rules for the digital asset ecosystem.

McHenry gave more details about the upcoming hearing in May during an address at the Consensus event on April 28. The chairman stressed that the hearing would represent the first comprehensive review of digital asset laws.

The legislation will define digital currency regulations and affect securities and commodities regulations. Consequently, if the bill becomes law, it will benefit the crypto market and the value of BTC/USD.

bitcoin price

At the moment, BTC/USD is consolidating around $29,330, with the leading digital currency gaining around 6.5% in price over the past week. Technically, bitcoin is facing immediate resistance near the $30,000 level, which is also acting as a psychological barrier.

Conversely, a substantial support could be found near the $29,000 mark. On the two-hour time frame, a downward sloping trendline is intersecting with an upward move for bitcoin.

The 50-day exponential moving average (EMA) is located near the $29,100 mark, indicating a potential uptrend for bitcoin.

If bitcoin can overcome the $30,000 resistance, it could target the $30,400 or $30,800 resistance. Conversely, if BTC breaks below the $29,100 mark, it could aim for the $28,800 or $28,200 levels.

Top 15 Cryptocurrencies to Watch in 2023

Apart from bitcoin, there is a diverse range of promising cryptocurrencies in the market including emerging altcoins and presale tokens that can deliver substantial returns.

As a result, the Cryptonews Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, each of which has demonstrated strong potential for both short-term and long-term growth.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

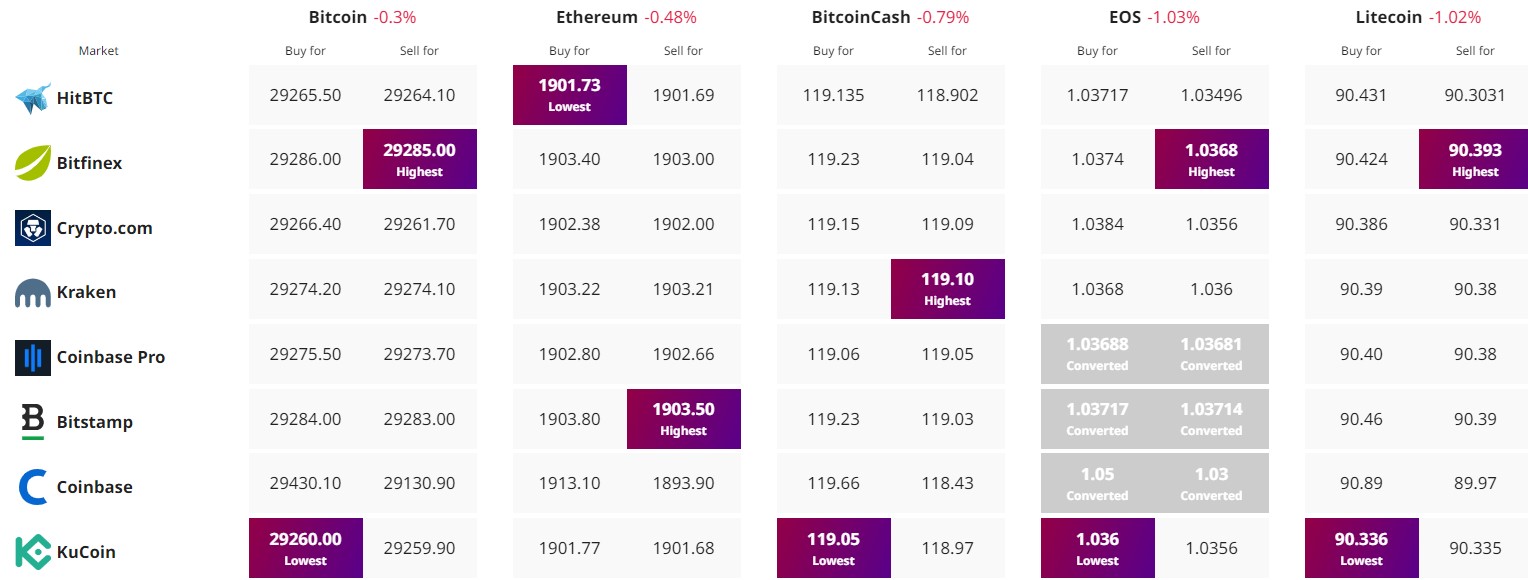

Find the best price to buy/sell cryptocurrency