BitcoinThe leading cryptocurrency is facing difficulties to overcome the important resistance level of $27,500.

Despite the recent bullish momentum, bitcoin’s upward momentum has been hindered by a persistent descending trend line.

Market sentiment remains cautious as traders closely monitor the performance of bitcoin, waiting for a decisive breakout or a possible retracement.

The next price action will likely be affected by the ability of bitcoin to overcome these barriers and establish a new direction.

Tether allocates millions to bitcoin as part of its reserve diversification plan

on Wednesday, lanyardThe organization behind USDT, the largest stablecoin by total market cap, announced It intends to acquire bitcoin as part of its reserve banking strategy.

By adding major cryptocurrencies to its balance sheet, Tether joins the ranks of other major institutions in diversifying their holdings.

The primary objective behind Tether’s upcoming purchase of bitcoin is to diversify its reserve holdings that back the USDT token.

This strategy ensures that the company maintains a 1 to 1 peg of USDT to USDT.

Tether plans to allocate approximately $222 million to this purchase, which is 15% of its net profit.

According to Tether CTO Paolo Ardoino, the decision to invest in bitcoin was taken considering its strength and potential as an investment.

The news of significant bitcoin purchases by Tether to back its USDT strengthened bitcoin and contributed to its positive momentum on Thursday.

Politicians in Korea Unite in Support of Crypto Regulations After High-Profile Murder Case

according to a Bloomberg In a May 18 report, a Korean woman was abducted on March 29 and later murdered in a dispute believed to be related to cryptocurrency-related losses.

The incident adds to a series of scandals involving digital assets, including the collapse of Do Kwon’s Terra Money ecosystem last May.

The recent murder case has reportedly increased pressure on the Korean government to urgently pass the country’s first independent cryptocurrency law, which could receive parliamentary approval later this month.

The proposed law would introduce stricter rules regarding reserve funds, account maintenance, and requiring digital asset companies to purchase insurance as protection against attacks.

These rules will apply to digital currencies such as bitcoin, while government-designated securities will continue to be governed by the existing capital markets law.

The news of this tragic murder case involving the digital asset has had an effect on the bitcoin price.

Pakistan’s Finance Minister: Cryptocurrencies are unlikely to gain legitimacy due to FATF

Minister of State for Finance and Revenue Aisha Ghaus Pasha said that Pakistan is ready to ban cryptocurrency services and has no intention of legalizing cryptocurrency trading.

The decision comes as a requirement of the Financial Action Task Force (FATF), which had earlier placed Pakistan on its “grey list” due to inadequate anti-money laundering and counter-terrorist financing measures.

The ban on cryptocurrencies was one of the conditions set by the FATF to remove Pakistan from the list. The State Bank of Pakistan (SBP) and the Ministry of Information and Technology collaborated to draft legislation for this ban.

This tight stance on cryptocurrencies in Pakistan has increased the pressure on the market and limited gains for the leading cryptocurrencies.

bitcoin price

Bitcoin It is trading at $27,290, having experienced less than 1% growth on Thursday.

BTC is facing challenges in reclaiming its $30,000 level since last month and is currently hovering around $27,000.

At the moment, bitcoin is facing a key resistance near the $27,500 level, which is acting as a double top pattern for BTC.

If bitcoin manages to break the $27,500 level on multiple time frames, it has the potential to target the next resistances at $27,700 or $28,000.

Further demand for BTC could even propel it above the $28,000 level, with the next resistance likely to be near the $28,300 level.

However, bitcoin is currently struggling to surpass the $27,500 level, which has been reinforced by a double top pattern, a descending trend line, and the formation of a bearish timer and spinning top candlestick below this level.

These indicators suggest potential weakness in the upward trend, with bitcoin potentially trading lower towards $27,000 and $26,800.

Therefore, it is important to monitor the $27,500 level as an important pivot point for bitcoin’s performance today.

Top 15 Cryptocurrencies to Watch in 2023

cryptonews The Industry Talk team has compiled a selection of promising cryptocurrencies for 2023 that demonstrate strong potential.

These cryptocurrencies display significant potential for growth in both the near and distant future.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

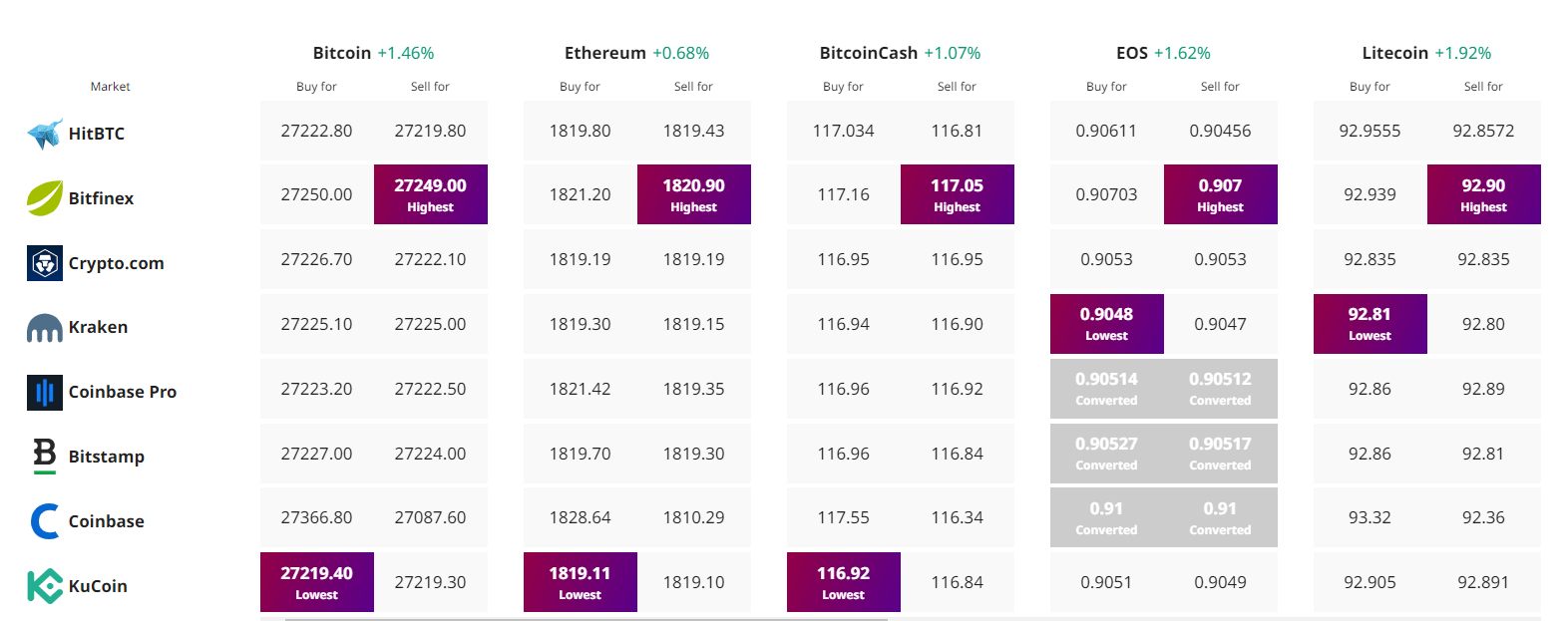

Find the best price to buy/sell cryptocurrency