Banks in Japan are launching a trial to issue fully compliant stable coins on an ultra-fast but massively centralized blockchain known as the Japan Open Chain.

The bank test will be the first experiment with a stablecoin in Japan that fully complies with local laws, a Press release Shipped on Thursday.

For now, the trial involves three Japanese banks, Minna no Bank, Tokyo Kiraboshi Financial Group, and Shikoku Bank, with each bank set to issue its own stablecoin.

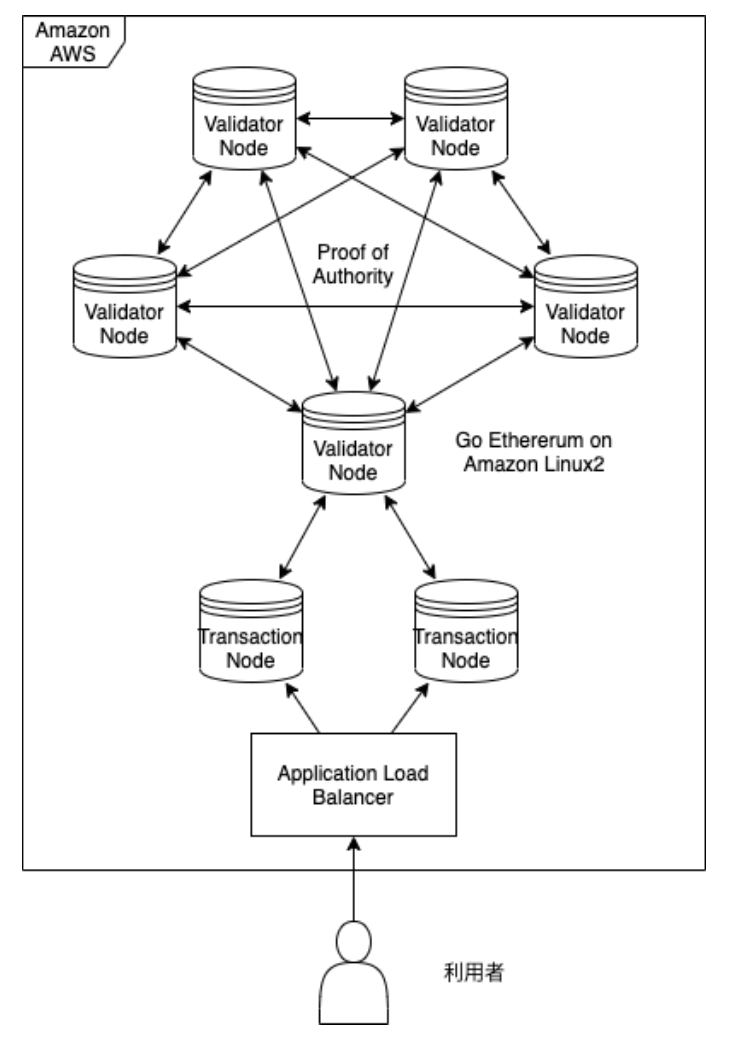

proof of authority

The blockchain the bank will use – Japan Open Chain – has been developed by local firm GU Technologies. The chain can reportedly process 1,000 transactions per second, and uses a consensus algorithm called Proof of Authority (PoA) instead of the more widely known Proof-of-Work (PoA).pow) or proof-of-stake (POS,

However, as is often the case, higher transaction speeds come at the cost of decentralization.

According to its website, Japan Open Chain has only six network validators, compared to the tens of thousands of node operators on the bitcoin network, for example. Over time, Japan Open Chain aims to increase the number of validators to 21 companies, its website states.

Fully compatible with Ethereum

The press release notes that Japan is fully compatible with the open chain Ethereum, which has the world’s largest ecosystem for decentralized applications.

It states that this makes the chain compatible with the popular Ethereum wallet metamaskWhich makes it easily accessible to a large number of regular crypto users.

Issuing stable coins on the Japan Open Chain would be a “great business opportunity” for Japanese financial institutions, potentially enabling them to process transactions made around the world, the press release concluded.